NAB has made reductions to NAB Choice Package fixed interest rates.

Effective Tuesday 10 November 2020, NAB reduced home loan fixed interest rates for Owner Occupiers paying Principal & Interest on 1-4 year fixed terms.

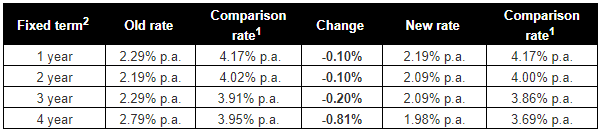

Advertised Fixed Rates for NAB Choice Package – Owner Occupiers – Principal & Interest

These rates are effective for fixed rates on new NAB Choice Package home loans from Tuesday 10 November 2020 and could be removed from offer at any time without notice.

There are no changes to NAB variable rates, or fixed rates for other home loan products.

Why have NAB made the decision to lower their rates?

These changes are generally designed to provide certainty to customers, boost confidence and support the post-COVID credit recovery with the lowest fixed rates ever.

This has come off the back of the sixth reduction in the cash rate during the past 18 months. With interest rates at record lows the banks are doing what they can to support homebuyers and business owners through COVID-19, while also balancing the impact on our deposit and savings customers.

The big 4 banks have had to act swiftly in the face of the pandemic to support Australian’s and avoid systematic defaults. They have done so from the beginning of this pandemic and are slated to continue to help Aussie borrowers through to March with the mortgage deferral support program.

How we can help

If you are looking to buy a home or refinance, there hasn’t been a better time. So, consider contacting us at Finance Mutual Australia, we are experts at finding the best home loan option to match your financial goals and your lifestyle needs, contact us today!

(08) 8216 4111

mail@financemutual.com.au

Further reading

Finance for Business Equipment.

Is it time to enter the property market?

270,000 Deferred mortgages remain

Refinance today, save over $5000 this year.

Become a referrer and earn $70,000 towards your mortgage!

The business impact of easing restrictions.

How COVID-19 created the Strangest Economy on Record.

Important information

The actual rate that will apply will be the effective fixed rate as at the day of drawdown, unless the customer takes out Rate Lock and that interest rate is lower than the advertised fixed rate at drawdown. This means that applications submitted prior to Tuesday 10 November 2020 will be eligible for the new rate. Please note that customers are not entitled to a refund of the Rate Lock fee even if they receive a lower interest rate at drawdown.

The above fixed rate changes do not impact existing loans.

NAB may change rates, including any special rate offer, at any time without notice.

Comparison rates are based on a secured loan of $150,000 over a term of 25 years.

WARNING: This comparison rate applies only to the examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.

Fixed rate loans may be subject to significant break costs. NAB Fixed Rate Home Loan products are not eligible for an interest offset arrangement, and you cannot redraw any additional repayments you’ve made during the fixed rate period. Fees and charges apply to selected NAB products Interest rates, fees and charges are subject to change. Refer to nab.com.au for full details. Fees and charges are current and may be introduced or varied in accordance with loan terms.

Terms and Conditions, and Fees and Charges apply to all NAB products and are available on application. NAB lending criteria applies.

Please note we do not provide tax, legal or accounting advice. Any information contained in this document is of a general nature only and does not take into account the objectives, financial situation or need of any particular person and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Therefore, before making any decision, you should consider the appropriateness of the information with regard to those matters and consult your own tax, legal and accounting advisors before engaging in or considering the appropriateness of any

transaction.